The 5-Minute Rule for Succentrix Business Advisors

The 5-Minute Rule for Succentrix Business Advisors

Blog Article

The smart Trick of Succentrix Business Advisors That Nobody is Discussing

Table of ContentsWhat Does Succentrix Business Advisors Mean?Succentrix Business Advisors Fundamentals ExplainedThe Greatest Guide To Succentrix Business AdvisorsNot known Details About Succentrix Business Advisors Little Known Questions About Succentrix Business Advisors.

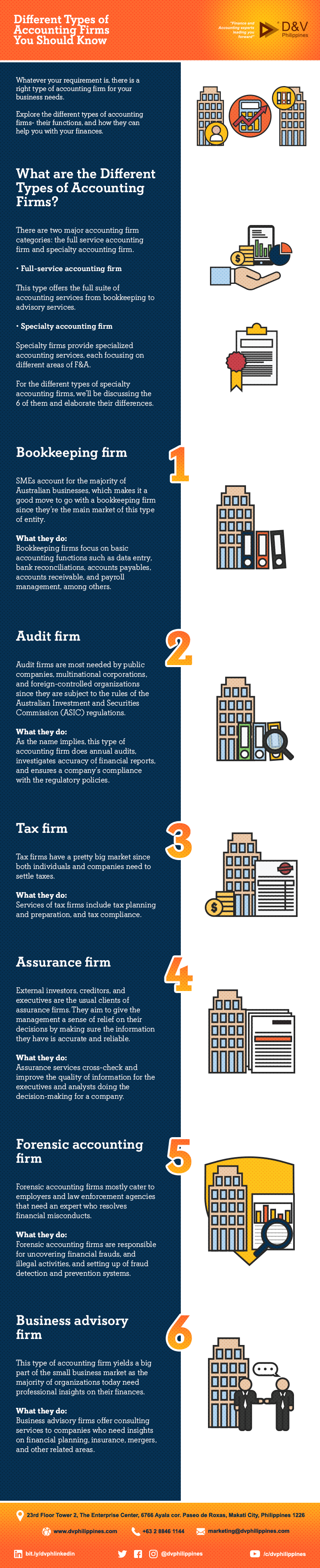

The framework and capabilities of the firm depend on range and range of solutions. Audit companies intend to provide quality services that aid businesses and individuals handle their funds and make audio choices concerning their money.CAS firms concentrate on advising accounting services instead than a compliance-heavy service. This fad in the bookkeeping industry changes to a focus on advisory bookkeeping solutions rather than a compliance-heavy solution.

Allow's get our phrases directly. Now that we recognize what to call it, let's find out concerning what it is! Historically, accounting organizations have been focused on the conformity side of points.

According to the & AICPA PCPS 2018 CAS Standard Survey Record, the 5 most usual client audit consultatory solutions offered are: 1099 development and declaring (91%) Economic statement prep work (89%) CFO/Controller Advisory solutions (88%) Accounts payable (86%) Sales tax returns (85%) As opposed to concentrating on just the nitty sandy i.e., tax obligations, deals, and points that have actually already happened, CAS firms likewise concentrate on the future and attempt to help their clients remain aggressive and make the best decisions for their organization holistically.

Some Ideas on Succentrix Business Advisors You Should Know

Compliance is the cake, and advising services are the icing on top. As opposed to frequently hounding your clients for the appropriate papers, the work becomes more of a partnership and the accountant is seen as part of the organization' team. Audit companies seeking to embrace advisory solutions right into their technique do not need to offload their conformity clientsthese customers are still terrific and it's alright to have both consultatory clients and compliance customers.

CAS firms have to do with changing the narrative concerning accountingyou're no more selling your time, you're offering your knowledge and knowledge. That's why CAS in accounting companies generally bill their clients ahead of time with a subscription, or value-based prices CAS design, and overview precisely what solutions their customers will certainly be receiving. This allows the accountancy company to have all year cash circulation and get paid prior to the work is done.

, CAS in accountancy firms are reported a median growth rate of 16% over the previous year reported by the 2022 AICPA PCPS and CPA.com Management of a Bookkeeping Practice (MAP) company benchmarking research study. Cover is a one-stop-shop for all of your accounting company's demands. Sign up complimentary to see just how our complete suite of solutions can assist you today.

Running a business includes a whole lot of accountancy. Every time you record a purchase, prepare tax obligation documents, or plan an expenditure, accounting is included.

The 10-Second Trick For Succentrix Business Advisors

If you're not thinking of recordkeeping and audit, the chances are that your records are a mess, and you're hardly scuffing by. Accountants do so much, and they do it with expertise and performance. That makes a huge difference for an organization. Obviously, accounting is a big area, and accountancy services can include several various things.

Accounting is regarding producing exact economic records and maintaining reliable recordkeeping techniques. Recordkeeping covers payment records, taxes, bank reconciliations - cpa near me, general journal, and payroll documents based upon durations of time. Bookkeepers also function to produce monetary declarations for testimonial. All of this falls under accountancy, yet an accounting professional can supply a lot more monetary advice than someone whose role falls completely under bookkeeping or click here now recordkeeping.

Licensed public accounting professionals (Certified public accountants) are usually contacted to prepare financial declarations for companies or to aid with tax filing at the individual or organization level. Accountant assist individuals to browse tax regulations and income tax return, and they often assist companies and individuals targeted by tax obligation audits. Federal, state, and city government entities operate a different scale than many companies.

Some Known Incorrect Statements About Succentrix Business Advisors

Meeting these standards needs specialized bookkeeping skills. Management bookkeeping is the kind that most commonly comes into play for small organizations.

Report this page